LivaNova has successfully completed the initial closing of the divestiture of its heart valve business to Gyrus Capital, an investment firm dedicated to investments in the healthcare and sustainability sectors, for an enterprise value of €60 million (US$73 million).

CORCYM, an independent company recently launched and owned by entities funded and controlled by Gyrus, will manage the heart valve business.

“The completion of the heart valve sale to Gyrus Capital allows LivaNova to optimise its portfolio and sharpen its focus on cardiovascular and neuromodulation, our two areas of excellence,” said Damien McDonald, chief executive officer of LivaNova. “We are now better positioned to accelerate growth in our core, dedicate resources toward executing promising pipeline opportunities, and enhance our operational excellence to best serve our patients and deliver maximum value to shareholders.”

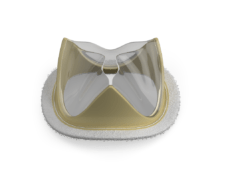

The heart valve business consists of a comprehensive portfolio of products, featuring Perceval, a sutureless aortic valve, and Memo 4D, a semi-rigid mitral annuloplasty ring.

Approximately 850 employees will transition to CORCYM as part of the global heart valve business, which has major operations in Saluggia, Italy and Vancouver, Canada. As of today, LivaNova and CORCYM completed the initial closing relating to CORCYM’s acquisition of the LivaNova heart valve business. In the initial closing, CORCYM acquired LivaNova manufacturing facilities in Saluggia and Vancouver and related assets in other geographies, representing most of the heart valve business. During the course of 2021, the parties expect to complete the transfer of the commercial operations in various local jurisdictions.