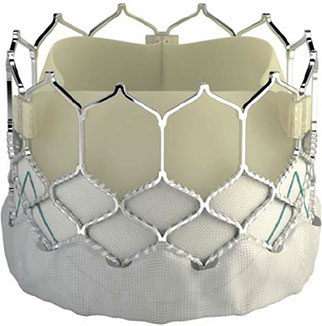

Edwards Lifesciences has received the CE mark for its Sapien 3 transcatheter aortic valve implantation (TAVI) device to be used to manage aortic stenosis in low-risk patients. Both Edwards and Medtronic (with its CoreValve Evolut range) have FDA approval for their devices to be used for low-risk patients in the USA but, with this new CE mark approval, Edwards is the first TAVI company to have this indication in Europe.

A press release reports that CE mark follows on from the publication of the PARTNER 3 results in the New England Journal of Medicine. The study, which was also presented at the 2019 American College of Cardiology (ACC) Scientific Session (16–18 March, New Orleans, USA), indicated that TAVI with Sapien 3 was superior to surgical aortic valve replacement for the management of aortic stenosis in patients at low surgical risk. At one year, the rate of the primary endpoint—a composite of all-cause death, stroke, or rehospitalisation—was 8.5% in TAVI patients (496 overall) vs. 15.1% in surgery patients (454 patients). Study investigators Michael Mack (Baylor Scott and White Hospital, Plano, USA) and others report in the New England Journal of Medicine: “The requirements for both non-inferiority and superiority were met, with an absolute difference between the TAVI group and the surgery group of -6.6 percentage points (p<0.001 for non-inferiority) and a hazard ratio of 0.54 (p=0.001 for superiority).”

Furthermore, after PARTNER 3 was published, a study on the health status of the PARTNER 3 patients was simultaneously presented at the 2019 Transcatheter Cardiovascular Therapeutics (TCT) meeting (25–29 September, San Francisco, USA) and published in the Journal of the American College of Cardiology. This showed that TAVI patients improved more rapidly than surgery patients, showing (according to a press release) a difference of 16 percentage points between groups in the Kansas City Cardiomyopathy Questionnaire overall summary scores at one month. The press release states that previous studies (in higher risk patients) have already shown TAVI to be associated with better (early) health status but notes that this study “also observed a sustained health status benefit of TAVI compared with surgical aortic valve replacement at later time points of six months (2.6 points; p=0.002) and one year (1.8 points; p=0.03).” Suzanne J Baron (Lahey Hospital and Medical Center, Burlington, USA) is quoted as saying: “Taken together with the clinical outcomes of the PARTNER 3 trial, these health status findings further support the use of TAVI in patients with severe aortic stenosis at low surgical risk.”

However, Mack et al do note that the “most important limitation” of their study is that the results “only reflect one-year outcomes and do not address the problem of long-term structural valve deterioration”. “Definitive conclusions regarding the advantages and disadvantages of TAVI as compared with surgery (with either bioprosthetic or mechanical valves) depend on long-term follow-up. In this trial involving younger low-risk patients, the protocol requires clinical and echocardiographic follow-up to continue for at least 10 years,” they add.

FDA approval

Prior to receiving CE-mark approval, on 16 August 2019, Edwards Lifesciences received FDA approval for the Sapien 3 range (Sapien 3 and Sapien 3 Ultra). At the time, Edwards’ corporate vice president, Larry L Wood, said: “This approval is a significant milestone that will allow all patients diagnosed with severe aortic stenosis to be considered for TAVI based on their individual preferences and anatomical considerations vs. traditional risk scoring.” Of note, the FDA has also approved Medtronic’s CoreValve Evolut range (Evolut R and Evolut Pro) for low-risk TAVI patients; in fact, the Sapien range and the CoreValve range received FDA approval on the same day.

However, about a week after the approval, the FDA issued a Class I recall (the most serious kind) for the delivery system of Sapien 3 Ultra. According to the FDA, the reason for the recall was because “Edwards Lifesciences has received reports of burst balloons during implantation procedures, which have resulted in significant difficulty in retrieving the valve into the catheter and withdrawing the system from the patient, which may cause vascular injury, bleeding, or surgical intervention”. The FDA goes on to state that use of an affected product may “cause serious adverse health consequences, including death”.

Although labelled a “Recall”, the announcement did not mean that the Sapien 3 Ultra system had to be taken off the market. Instead, the FDA referred physicians to an Urgent Field Safety notice that Edwards sent to customers on 9 July 2019. This notice outlined instructions for deploying the Sapien 3 Ultra system and what to do the in the event of a burst balloon.

Effect of approvals on TAVI market

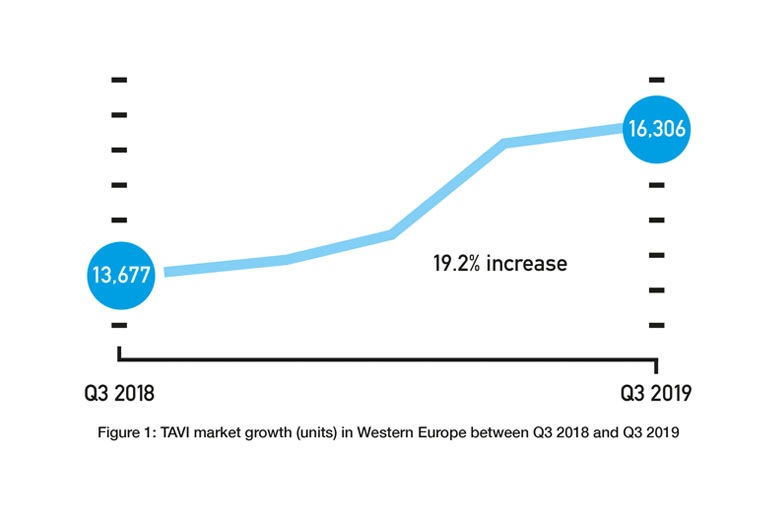

Given the FDA approvals only happened in Q3 2019 and the CE mark approval only happened in Q4 2019, their impact on the respective US and European markets is unknown. However, assuming that they will lead to an increased use of TAVI (and an increased use of TAVI in low-risk patients) would be reasonable. TAVI is already a growing market. The BIBA MedTech Insights TAVI Monitor, which tracks data on a quarterly basis, shows that the number of TAVI implants in Western Europe increased from 13,677 in Q3 2018 to 16,306 in Q3 2019—a 19.2% increase (see Figure 1). Therefore, if the TAVI market does continue to grow, the key questions are whether the rate at which it is growing will increase and how much is attributable to low-risk patients.

The proportion of TAVI procedures performed in low-risk patients also increased between Q3 2018 and Q3 2019: from 4.6% to 5.2%. Going forward, again, (assuming this growth continues) a question is whether the rate at which this proportion is growing will increase.

Another unknown is how getting the CE mark for low-risk will affect Edwards Lifesciences’ market share. The company is already the market leader and is likely to remain in this position, so the question is whether its share of the market (43% in Q3 2019) will increase. This is more difficult to predict given Medtronic may soon receive CE mark approval for CoreValve to be used in low-risk patients (like Edwards, Medtronic has positive data for low-risk patients) and other valves may come onto the market.

This article is part of a series of BIBA Briefings columns published in Cardiovascular News. For previous columns, see our BIBA Briefings page.

BIBA Briefings provide in-depth analysis of market intelligence from BIBA MedTech Insights. They also review that the latest technology news and pipeline developments.

For editorial enquiries, please contact Dawn Powell: [email protected]

For sales enquiries (including BIBA MedTech Insights), please contact Merveille Anderson: [email protected]