Philips and Spectranetics have announced that they have entered into a definitive merger agreement. Pursuant to the agreement, a press release reports, Philips will commence a tender offer to acquire all of the issued and outstanding shares of Spectranetics for US$38.50 per share to be paid in cash upon completion.

The press release states that the board of directors of Spectranetics has approved the transaction and recommends the offer to its shareholders. It adds that the transaction is expected to close in the third quarter of 2017.

The acquisition of Spectranetics, according to the press release, will further expand and strengthen Philips’ image-guided therapy business group. Spectranetics positions itself as a leader in vascular intervention to treat coronary and peripheral artery disease, and in lead management for the minimally invasive removal of implanted pacemaker and implantable cardioverter defibrillator (ICD) leads. The press release notes that the company is currently growing double digits and projects 2017 sales to be in the range of US$293million to US$306million.

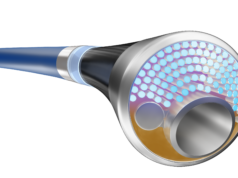

Spectranetics’ device portfolio includes a range of laser atherectomy catheters for treatment of blockages with laser energy in both coronary and peripheral arteries. For example: the AngioSculpt scoring balloon used to mechanically push a blockage aside in both peripheral and coronary arteries; the AngioSculptX scoring balloon, the only drug-coated scoring balloon in the market; and the Stellarex drug-coated balloon, which treats common to complex lesions while inhibiting the recurrence of these blockages.

Frans van Houten, chief executive officer of Royal Philips, says: “Today’s exciting announcement follows a series of bolt-on acquisitions to strengthen our portfolio across the health continuum. Building on the successful integration of the Volcano acquisition in early 2015, we are now accelerating our strategic expansion into therapy devices with the agreement to acquire Spectranetics. This transaction is expected to be revenue growth and profit accretive by 2018, given the projected revenue and productivity synergies. Spectranetics’ highly competitive product range, integrated with our portfolio of interventional imaging systems, devices, software and services will enable clinicians to decide, guide, treat and confirm the appropriate cardiac and peripheral vascular treatment to deliver enhanced care for patients with better outcomes, as well as significantly boost recurring revenue streams for Philips.”

Upon completion of the transaction, Spectranetics and its more than 900 employees will become part of the image-guided therapy business group within Philips. Spectranetics’ standalone revenue growth is expected to be double-digit and adjusted EBITA to be positive by 2018. Philips sees sustained high sales growth through new product introductions across a highly synergistic therapy device portfolio. Moreover, the transaction will enhance the geographical expansion of Spectranetics’ products and commercialization opportunities in new, adjacent segments. As part of Philips, the Spectranetics business will benefit immediately from Philips’ platform enabling cost and working capital synergies.