A new study indicates that the Meridian transcatheter aortic valve implantation (TAVI) valve (HLT) is associated with a 30-day mortality rate of 8% and a six-month mortality rate of 12%. The valve is fully retrievable after deployment, which allows an accurate assessment of valve positioning and performance prior to final release. Most self-expanding devices are partially retrievable, with only one fully retrievable device (Lotus Edge, Boston Scientific) available.

Josep Rodés-Cabau (Department of Cardiology, Quebec Heart and Lung Institute, Laval University, Quebec City, Canada) and others report in Circulation: Cardiovascular Interventions that the ability to evaluate a partially retrievable valve in its final position and full expansion before release is limited. “Both final frame expansion and potential movements of the valve system at the time of final release may result in changes in final positioning, valve performance, or coronary artery obstruction,” they explain.

The authors comment that, by contrast, fully retrievable valves (such as the Meridian and Lotus Edge devices) “allow for an accurate assessment of the valve positioning and performance in addition to any interaction with the coronary arteries before final release, knowing that the position and shape of the valve will not change after final release”.

The aim of the present study was to evaluate the early feasibility of TAVI with the Meridian valve in patients at high surgical risk. According to Rodés-Cabau et al, the device consists of “three leaflets of porcine pericardium and a braided liner to reduce paravalvular leak. The valve leaflets are attached to a nitinol wireform that flexes with each closure to reduce the leaflet stress at commissures”.

In the study, 25 patients underwent TAVI with the Meridian device. In 40% of patients, the initial valve position was considered to be too high or too low and, thus, the valve had to be repositioned. Rodés-Cabau et al report that this suboptimal valve positioning “was in large part” because of the learning curve process “particularly with a self-expanding valve system that requires a two-step process to achieve final deployment”. They add that there was a “marked reduction” in valve repositioning with the Lotus valve after the initial clinical experience. Furthermore, the authors note that only a single valve size (25mm) was available in the study and this “represents an important limitation”.

At 30 days, two patients had died—meaning that the mortality rate was 8%—and both deaths were of a suspected arrhythmic cause. Based on the subsequent autopsies, the valve was in the correct position in both cases and there was no evidence of valve thrombosis. Acknowledging that the mortality rate in the study was higher than that seen in TAVI studies of patients at intermediate-to-high surgical risk, Rodés-Cabau et al state that all patients in the study were deemed by the heart team to be at high risk and “were older than those included in most previous studies”. “Also, preprocedural frailty was common (44%) and likely contributed to high surgical risk despite a mean STS-PROM Score <8%,” they observe.

Other 30-day findings show that the stroke rate was also 8%, and there was a significant increase in effective orifice area and decrease in mean gradient vs. baseline values. Most patients (80%) were in New York Heart Association (NYHA) Class I-II. At six months, the mortality rate was 12% (including the two patients who died before 30 days), 89% of patients remained in NYHA class I–II, and there were no significant changes in valve performance over time.

The authors state that the valve is now being evaluated in a CE mark trial (200 patients at intermediate or high risk) and there are plans to initiate a US Food and Drug Administration (FDA) trial later this year. They add that several iterations of the Meridian valve system are being undertaken and will include several design improvements, including enhanced valve inversion properties to “facilitate valve positioning and reduce valve retrieval attempts”. An expanded range of valve sizes is also planned.

Rodés-Cabau et al conclude: “These valve iterations along with the increasing experience of operators/centres should translate into further improvement in clinical and echocardiographic results.” Rodés-Cabau told BIBA Briefings: “The Meridian valve is ‘fully retrievable’. This is a very important differential feature from most available transcatheter valve systems.”

Current use of fully retrievable devices

As mentioned, Boston Scientific’s Lotus Edge is the only TAVI device on the market that is fully repositionable. However, problems with the delivery system meant that it was off the market for just over two years. After receiving the CE in September 2016, Lotus Edge (along with the earlier generation Lotus valve) was taken off the market in February 2017. Initially, Boston Scientific planned for Lotus/Lotus Edge to be back on the market by Q1 2018 and to file for FDA approval for the device around the same time. However, because of several delays, Lotus Edge only came back on the market in March of this year (via a controlled launch). It received FDA approval April this year (making it the third TAVI device on the US market).

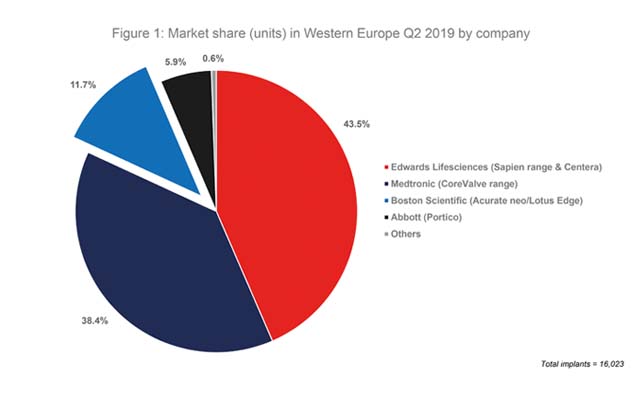

Of note, Boston Scientific acquired Symetis in March 2017 and, therefore, also has the Acurate Neo device (developed by Symetis) on the market. In Q2 2019, according to the BIBA MedTech TAVI monitor, 11.7% of all TAVI devices implanted in Western Europe (16,203) were a Boston Scientific device—meaning that the company had the third-highest market share. See Figure 1.

Source: BIBA MedTech TAVI Monitor

In Q2 2016, prior to its Lotus range being taken off the market and prior to its acquisition of Symetis, Boston Scientific had a market share of 7.0% in terms of units implanted. Given that the Lotus Edge was not CE mark approved until September 2016, this figure relates to implants of the earlier generation Lotus valve.

This article is part of a series of BIBA Briefings columns published in Cardiovascular News. For previous columns, see our BIBA Briefings page.

BIBA Briefings Insights reports give in-depth analysis of the latest market intelligence from BIBA MedTech Insights. They also review that the latest technology news and pipeline developments.

For editorial enquiries, please contact Dawn Powell: [email protected]

For sales enquiries (including BIBA MedTech Insights), please contact Merveille Anderson: [email protected]