Edwards Lifesciences—in a press statement announcing its global second quarter (Q2) financial results—has revealed that it is taking the self-expanding transcatheter aortic valve implantation (TAVI) device Centera off the market. The company says resources will instead be focused on the balloon-expanding Sapien range of TAVI devices, adding that it expects the US Food and Drug Administration (FDA) to approve Sapien 3/Sapien 3 Ultra for low-risk patients this quarter (Q3).

The Centera valve has only been on the European market for just over a year and has never been approved for the US market. According to Michael A Mussallem, chairman and CEO of Edwards Lifesciences, Centera has “demonstrated excellent clinical outcomes and is performing well for patients” but the company took the “difficult decision” to take it off the market because “the time and resources required to optimise deliverability as well as expanding the indications [of Centera] to match [those of] the Sapien 3 valve are significant”. Sapien 3 is indicated for intermediate-risk, high-risk, and inoperable patients (in Europe and the USA), and may soon be indicated for low-risk patients. “We now estimate that in the third quarter [of this year], the FDA will approve the Sapien 3 and the Sapien 3 Ultra valve for patients with low surgical risk,” Mussallem comments. By contrast, Centera is only indicated for high-risk/inoperable patients.

Prior to reporting its Q2 results, Edwards Lifesciences issued an urgent field safety notice for Centera. In the notice, the company says it has received reports “of difficulty tracking and manipulating the Centera system around the aortic arch that resulted in vascular injury including aortic dissection and death during early cases”. It adds that a “thorough investigation” of these reports shows that the tracking difficulty is “more likely to occur when the device is used in specific tortuous aortic anatomies”. “The observed incidence of serious events related to this issue is approximately 1.5% based on the limited global experience with this device to date,” Edwards Lifesciences reports. It goes on to specify anatomies for which alternative treatment options to Centera should be considered and recommends pre and intra procedural steps to reduce the risk of having problems with tracking the device. In the notice, the company also provides advice on what operators should do if they encounter such problems.

Usage of Centera and Sapien 3 Ultra in Western Europe

The BIBA MedTech TAVI monitor started to track the use of Centera valve in Western Europe in Q2 2018 (the device received the CE mark in February 2018). In that quarter, 2.3% of all Edwards’ TAVI valves implanted (6,541 overall) were a Centera valve. However, Centera accounted for less than 2% of all Edwards TAVI valves implanted in each subsequent quarter (Q3 2018–Q1 2019). See Figure 1.

Of note, in November 2018, Edwards Lifesciences received the CE mark for its Sapien 3 Ultra device and the TAVI Monitor started to track the use of this device in Q1 2019. In this quarter, 2.8% of all Edwards’ TAVI devices implanted in Q1 2019 were a Sapien 3 Ultra (see Figure 1). Mussallem says that, over time, Edwards expects that “the Sapien 3 Ultra valve system will replace the Sapien 3 valve globally”.

However, Sapien 3 Ultra’s potential to replace Sapien 3 may be hampered by the fact it was the subject of an urgent safety notice recently issued by Edwards Lifesciences. The company sent out the safety notice for Sapien 3 Ultra shortly after it issued the one for Centera (within the same calendar month); in the notice, it states that there have been reports of “burst balloons” with the device and these have “resulted in significant difficulty retrieving the Sapien 3 Ultra delivery system into the sheath and withdrawing the system from the patient”. “The overall observed complaint rate for balloon burst is approximately 1.0% based on the limited experience with the device of which approximately 0.5% had clinical implications for the patient such as difficulty removing the delivery system, vascular injury, bleeding and/or need for surgical intervention,” Edwards Lifesciences comments. Similar to its advice in the Centera safety notice, it outlines recommendations for avoiding burst balloons and what to do should the operator suspect that a balloon has burst.

Edwards Lifesciences’ market share

The effect of Centera being taken off the market and the effect of the recent safety notice for Sapien 3 Ultra on Edwards Lifesciences’ market share is not yet known. Also unknown is the potential impact of Sapien 3/Sapien 3 Ultra being approved for low-risk patients; although presuming they are approved for this indication, the number of implanted Edwards’ devices may increase.

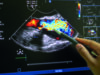

At present, Edwards Lifesciences is the market leader in the Western European TAVI market and has been for some time (including before either Centera or Sapien 3 Ultra were on the market). In Q1 2019, for example, 43.2% of all TAVI devices implanted (15,603) were an Edwards valve vs. 39.9% for Medtronic devices (CoreValve range) vs. 11.2% for Boston Scientific devices (Acurate neo). See Figure 2.

According to the press statement announcing the Q2 financial results, Edwards Lifesciences reported TAVI sales of US$678m globally in Q2 2019—an increase of 16% over the second quarter of 2018 and an increase of 18% on an underlying basis. Furthermore, Edwards grew in-line with estimated global procedural growth.

Speaking about all Edwards Lifesciences’ financial results overall (including sales for its transcatheter mitral and tricuspid devices), Mussallem comments: “We are very pleased with our strong performance in the first half of 2019. As patients and clinicians increasingly understand the significant benefits of transcatheter-based technologies, supported by the substantial body of compelling evidence, we remain as optimistic as ever about the long-term growth opportunity. Our foundation of leadership, combined with robust technology pipeline, positions us well for continued longer-term success.”

This article is part of a series of BIBA Briefings columns published in Cardiovascular News. For previous columns, see past issues.

BIBA Briefings Insights reports give in-depth analysis of the latest market intelligence from BIBA MedTech Insights. They also review that the latest technology news and pipeline developments.

For editorial enquiries, please contact Dawn Powell: [email protected]

For sales enquiries (including BIBA MedTech Insights), please contact Merveille Anderson: [email protected]